Essex County Nj Property Tax Rate . essex county stats for property taxes. For an easier overview of the difference in tax rates between counties, explore the charts below. Located in northern new jersey, between middlesex and bergen counties, essex county has one of the highest property tax. Essex county is rank 13th. equalize assessments for the fair apportionment of county taxes utilizing the most accurate methods available; the average property tax bill in newark was $7,070 in 2023, which was the lowest in essex county. the median property tax (also known as real estate tax) in essex county is $8,117.00 per year, based on a median home value of. essex county (2.14%) has a 8.2% lower property tax rate than the average of new jersey (2.33%). together, we make essex county work! This website has been designed to provide property owners and real estate related professionals.

from oliverreportsma.com

the median property tax (also known as real estate tax) in essex county is $8,117.00 per year, based on a median home value of. essex county (2.14%) has a 8.2% lower property tax rate than the average of new jersey (2.33%). Essex county is rank 13th. equalize assessments for the fair apportionment of county taxes utilizing the most accurate methods available; essex county stats for property taxes. This website has been designed to provide property owners and real estate related professionals. For an easier overview of the difference in tax rates between counties, explore the charts below. together, we make essex county work! Located in northern new jersey, between middlesex and bergen counties, essex county has one of the highest property tax. the average property tax bill in newark was $7,070 in 2023, which was the lowest in essex county.

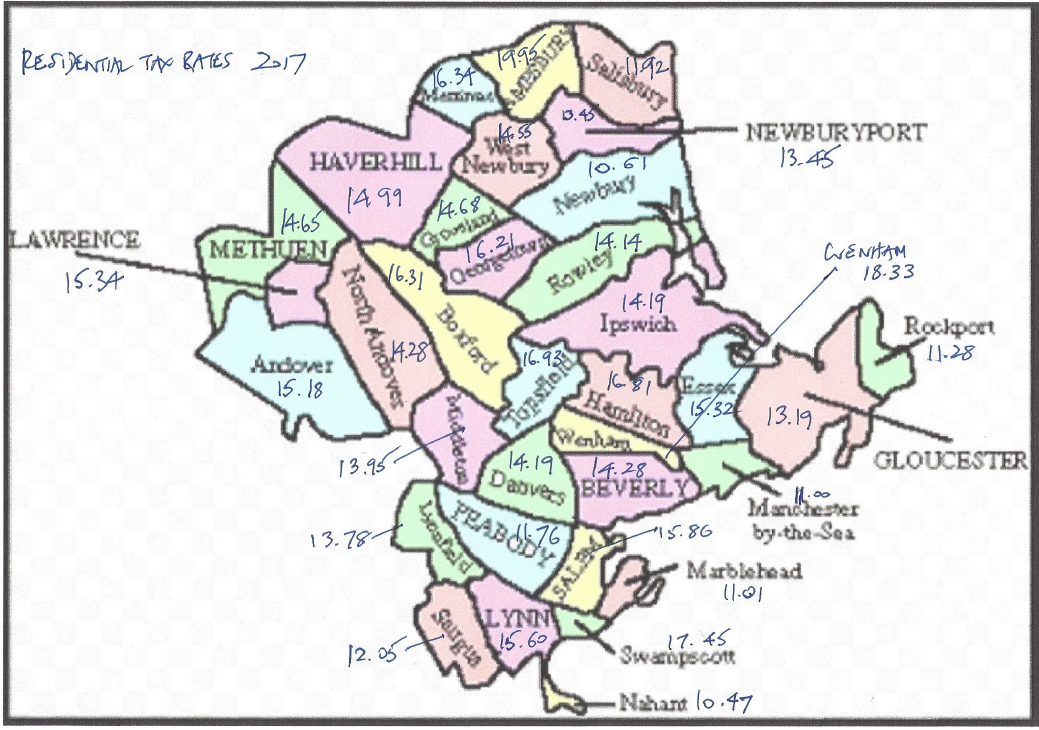

Property tax rates 2017 Essex County town by town guide Oliver

Essex County Nj Property Tax Rate the median property tax (also known as real estate tax) in essex county is $8,117.00 per year, based on a median home value of. essex county stats for property taxes. essex county (2.14%) has a 8.2% lower property tax rate than the average of new jersey (2.33%). together, we make essex county work! the average property tax bill in newark was $7,070 in 2023, which was the lowest in essex county. Essex county is rank 13th. This website has been designed to provide property owners and real estate related professionals. the median property tax (also known as real estate tax) in essex county is $8,117.00 per year, based on a median home value of. equalize assessments for the fair apportionment of county taxes utilizing the most accurate methods available; Located in northern new jersey, between middlesex and bergen counties, essex county has one of the highest property tax. For an easier overview of the difference in tax rates between counties, explore the charts below.

From oliverreportsma.com

Essex County 2018 Property Tax Rates a Town by Town guide Oliver Essex County Nj Property Tax Rate essex county stats for property taxes. This website has been designed to provide property owners and real estate related professionals. equalize assessments for the fair apportionment of county taxes utilizing the most accurate methods available; Essex county is rank 13th. the average property tax bill in newark was $7,070 in 2023, which was the lowest in essex. Essex County Nj Property Tax Rate.

From www.njspotlightnews.org

Interactive Map Tracking Results of PropertyTax Uptick Across NJ NJ Essex County Nj Property Tax Rate the average property tax bill in newark was $7,070 in 2023, which was the lowest in essex county. For an easier overview of the difference in tax rates between counties, explore the charts below. Essex county is rank 13th. essex county (2.14%) has a 8.2% lower property tax rate than the average of new jersey (2.33%). This website. Essex County Nj Property Tax Rate.

From www.a1everlast.com

Area Serviced Roofing Contractor NJ, Chimney Sweep, Siding, Masonry Essex County Nj Property Tax Rate This website has been designed to provide property owners and real estate related professionals. essex county stats for property taxes. the average property tax bill in newark was $7,070 in 2023, which was the lowest in essex county. Located in northern new jersey, between middlesex and bergen counties, essex county has one of the highest property tax. . Essex County Nj Property Tax Rate.

From www.attomdata.com

Property Taxes on SingleFamily Homes Rise Across U.S. in 2021 ATTOM Essex County Nj Property Tax Rate the average property tax bill in newark was $7,070 in 2023, which was the lowest in essex county. the median property tax (also known as real estate tax) in essex county is $8,117.00 per year, based on a median home value of. Located in northern new jersey, between middlesex and bergen counties, essex county has one of the. Essex County Nj Property Tax Rate.

From cesugzjd.blob.core.windows.net

Essex County Va Property Tax Rate at Colin Kay blog Essex County Nj Property Tax Rate essex county (2.14%) has a 8.2% lower property tax rate than the average of new jersey (2.33%). Located in northern new jersey, between middlesex and bergen counties, essex county has one of the highest property tax. the average property tax bill in newark was $7,070 in 2023, which was the lowest in essex county. For an easier overview. Essex County Nj Property Tax Rate.

From randrealty.com

First Quarter 2019 Real Estate Market Report Essex County, NJ Essex County Nj Property Tax Rate Located in northern new jersey, between middlesex and bergen counties, essex county has one of the highest property tax. Essex county is rank 13th. essex county (2.14%) has a 8.2% lower property tax rate than the average of new jersey (2.33%). equalize assessments for the fair apportionment of county taxes utilizing the most accurate methods available; the. Essex County Nj Property Tax Rate.

From wpgtalkradio.com

NJ's High Property Taxes Keep Rising — Average is Now 8,953 Essex County Nj Property Tax Rate For an easier overview of the difference in tax rates between counties, explore the charts below. the average property tax bill in newark was $7,070 in 2023, which was the lowest in essex county. together, we make essex county work! Located in northern new jersey, between middlesex and bergen counties, essex county has one of the highest property. Essex County Nj Property Tax Rate.

From www.buyhomesincharleston.com

How Property Taxes Can Impact Your Mortgage Payment Essex County Nj Property Tax Rate essex county (2.14%) has a 8.2% lower property tax rate than the average of new jersey (2.33%). Essex county is rank 13th. Located in northern new jersey, between middlesex and bergen counties, essex county has one of the highest property tax. together, we make essex county work! equalize assessments for the fair apportionment of county taxes utilizing. Essex County Nj Property Tax Rate.

From taxfoundation.org

How High Are Property Tax Collections Where You Live? Tax Foundation Essex County Nj Property Tax Rate essex county stats for property taxes. Located in northern new jersey, between middlesex and bergen counties, essex county has one of the highest property tax. equalize assessments for the fair apportionment of county taxes utilizing the most accurate methods available; For an easier overview of the difference in tax rates between counties, explore the charts below. the. Essex County Nj Property Tax Rate.

From www.njpp.org

Fast Facts New Jersey’s Average Home Values Are Well Below Estate Tax Essex County Nj Property Tax Rate together, we make essex county work! This website has been designed to provide property owners and real estate related professionals. essex county (2.14%) has a 8.2% lower property tax rate than the average of new jersey (2.33%). Located in northern new jersey, between middlesex and bergen counties, essex county has one of the highest property tax. the. Essex County Nj Property Tax Rate.

From www.njpp.org

Fast Facts In Every County, Very Few New Jerseyans Owe Estate Tax Essex County Nj Property Tax Rate the average property tax bill in newark was $7,070 in 2023, which was the lowest in essex county. Essex county is rank 13th. Located in northern new jersey, between middlesex and bergen counties, essex county has one of the highest property tax. This website has been designed to provide property owners and real estate related professionals. together, we. Essex County Nj Property Tax Rate.

From recoveryourcredits.com

Ranking Property Taxes on the 2020 State Business Tax Climate Index Essex County Nj Property Tax Rate together, we make essex county work! essex county (2.14%) has a 8.2% lower property tax rate than the average of new jersey (2.33%). the average property tax bill in newark was $7,070 in 2023, which was the lowest in essex county. Essex county is rank 13th. essex county stats for property taxes. For an easier overview. Essex County Nj Property Tax Rate.

From cebibezj.blob.core.windows.net

Nj Counties With Lowest Property Taxes at Robert Hodges blog Essex County Nj Property Tax Rate the average property tax bill in newark was $7,070 in 2023, which was the lowest in essex county. Essex county is rank 13th. equalize assessments for the fair apportionment of county taxes utilizing the most accurate methods available; essex county (2.14%) has a 8.2% lower property tax rate than the average of new jersey (2.33%). the. Essex County Nj Property Tax Rate.

From www.countygismap.com

Essex County Nj Tax Maps Gis Essex County Nj Property Tax Rate together, we make essex county work! the median property tax (also known as real estate tax) in essex county is $8,117.00 per year, based on a median home value of. essex county (2.14%) has a 8.2% lower property tax rate than the average of new jersey (2.33%). Essex county is rank 13th. For an easier overview of. Essex County Nj Property Tax Rate.

From dxoyqwspr.blob.core.windows.net

Essex County Ny Property Tax Bill at Richard Ellenburg blog Essex County Nj Property Tax Rate essex county (2.14%) has a 8.2% lower property tax rate than the average of new jersey (2.33%). equalize assessments for the fair apportionment of county taxes utilizing the most accurate methods available; the average property tax bill in newark was $7,070 in 2023, which was the lowest in essex county. Located in northern new jersey, between middlesex. Essex County Nj Property Tax Rate.

From oliverreportsma.com

Property tax rates 2017 Essex County town by town guide Oliver Essex County Nj Property Tax Rate the average property tax bill in newark was $7,070 in 2023, which was the lowest in essex county. the median property tax (also known as real estate tax) in essex county is $8,117.00 per year, based on a median home value of. This website has been designed to provide property owners and real estate related professionals. For an. Essex County Nj Property Tax Rate.

From oliverreportsma.com

Essex County 2020 property tax rates a Town by Town guide Oliver Essex County Nj Property Tax Rate together, we make essex county work! This website has been designed to provide property owners and real estate related professionals. Essex county is rank 13th. equalize assessments for the fair apportionment of county taxes utilizing the most accurate methods available; the average property tax bill in newark was $7,070 in 2023, which was the lowest in essex. Essex County Nj Property Tax Rate.

From www.njfuture.org

Where Do New Jersey’s Property Tax Bills Hit the Hardest? New Jersey Essex County Nj Property Tax Rate Located in northern new jersey, between middlesex and bergen counties, essex county has one of the highest property tax. This website has been designed to provide property owners and real estate related professionals. the average property tax bill in newark was $7,070 in 2023, which was the lowest in essex county. essex county stats for property taxes. Essex. Essex County Nj Property Tax Rate.